Trends change,

foundations stay.

Building finance foundations with commitment to smart and strategic investment decisions.

A Word From Accouche

Accouche Capital started with the firm belief that no matter where you are in the world, there’s always an opportunity to build, scale, and grow. With our venture, we wish to grow our funds, attract new investors, and build solid portfolios for our investors, and help small businesses and entrepreneurs in the process. Thank you for visiting.

Deepak Gupta

CFO, Accouche Capital

Our Funds

₹ 50,00,000

With half a crore in funds, we want to test the waters and explore the possibilities of wealth generation through options trading, IPOs, and strategic investments in small businesses among others.

Fund Allocation

We’ll be using 80% of our funds for options trading and the rest 20% for IPOs.

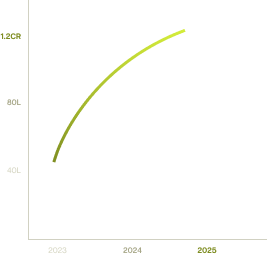

Projections for next year

By 2025, we’re targeting 52% returns on our initial capital, plus half a crore of fresh investments.

1%

of total capital every week

52%

of total capital in one year

Additionally, we want to raise

₹ 50,00,000

in 2024 from various investors to increase our working capital.

By 2025

Our total funds would’ve grown to ₹1.26CR (pre-taxes) from returns and fresh investments.

Money is made.

Trust is gained.

Accouche is backed by visionaries who believe local is the new global.